Corporate Finance Services

Charcot Capital provides corporate finance advisory services to a select number of clients with whom we have built longstanding relationships.

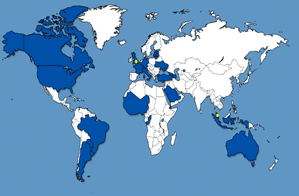

Our primary focus is cross border transactions in both developed and emerging markets.

Mergers & Acquisitions

Our advice is independent and without conflict. We cover all areas of M&A including acquisition (“buy-side”) advice and sale and divestiture (“sell-side”) advice as well as ongoing strategic advice to ensure that owners and managers are well positioned to grow their businesses.

Disposals

We have extensive experience in sell-side processes advising corporate clients and financial sponsors on disposals and auction processes as well as in privatizations. Our partners have a strong record for completing transactions and achieving prices beyond client expectations.

Joint Ventures and Strategic Partnerships

The success of a partnership requires a sound understanding of operating contributions and corporate governance issues, coupled with the capability to ensure alignment of interests between complementary partners. We have significant experience in structuring corporate partnerships across geographies: we approach these projects through a comprehensive review of operating and corporate governance scenarios so that they can be efficiently prepared and resolved from the outset.

Public Transactions

Our partners have been involved in public transactions including unsolicited and friendly takeover bids, mergers of equals, takeover defence and private investment in public equity across a wide range of jurisdictions including the UK, continental Europe, the Americas and Australia. Regulated in the UK by the Financial Conduct Authority, authorised by the Monetary Authority of Singapore to operate as an exempt corporate finance adviser and with a passport to operate in EEA countries, Charcot Capital aims to be involved in public advisory mandates in jurisdictions we master best. In other jurisdictions Charcot Capital may link up with local advisors on an ad hoc basis in order to provide longstanding clients additional financial, tactical and strategic advice.

Capital Raising

We seek to identify and introduce the best suited potential partners and investors to our clients. We have developed solid relationships with financial sponsors and alternative managers, as well as with some family offices. We also have a close relationship with some established fund raising specialists whose superior level of contacts with institutional investors broadens our clients’ range of potential capital raising solutions.

Buyouts

We have extensive experience working with Private Equity funds. Our partners have an outstanding record accompanying financial sponsors from the initial investment to successful exit. Our partners have made co-investments in assets alongside clients in the tradition of merchant banking whereby a close relationship always prevails over any risk of conflicts of interests.

Restructuring / Recapitalisations

We have experience advising on restructurings and re-organisations, including balance sheet restructuring, shareholding reshuffle, renegotiation of loan agreements and transactions aimed at firming up a company’s capital base.

We have successfully assisted companies and shareholders in the resolution of corporate governance issues and post transaction disputes such as valuation of earn-out post sale of a company and the re-alignment of shareholders’ interests in respect of liquidity and financial returns.